Startup fundraising sounds like a numbers game, but it is the secret engine behind some of the fastest-growing companies in America. Nearly two out of every three startups fail due to lack of funding, which flips the script on the old idea that it is all about the product. The real surprise is that getting money is not just about cash—it is about unlocking doors to networks, expert support, and business credibility most founders never see coming.

Table of Contents

- Defining Startup Fundraising: What It Is

- The Importance of Startup Fundraising: Why It Matters

- Different Types of Funding: How They Work

- Key Concepts in Startup Fundraising: Understanding the Terms

- The Role of Investors: Who They Are and What They Seek

Quick Summary

| Takeaway | Explanation |

|---|---|

| Startup fundraising fuels growth and innovation | It provides essential capital for turning ideas into operational businesses and overcoming market entry challenges. |

| Diversified funding sources are essential | Options include personal savings, angel investors, venture capital, and grants, each with unique advantages and limitations. |

| Clear value propositions attract investors | Founders must communicate potential growth and innovative solutions to gain investor confidence and support. |

| Understanding valuation is crucial | Knowing pre-money and post-money valuations shapes equity distribution and expected investor returns. |

| Investors seek more than just returns | They look for strong teams and innovative ideas that signal substantial market disruption and growth potential. |

Defining Startup Fundraising: What It Is

Startup fundraising represents the strategic process of acquiring external capital to transform entrepreneurial vision into operational reality. This financial mechanism enables founders to secure necessary resources for developing products, expanding market reach, and building sustainable business infrastructures. Unlike traditional business financing, startup fundraising involves multiple stages of investment that align with a company’s growth trajectory and specific developmental needs.

The Core Concept of Capital Acquisition

At its fundamental level, startup fundraising is about converting potential into tangible business momentum. Entrepreneurs seek financial support from various sources to bridge the gap between innovative ideas and market execution. The process goes beyond simple monetary transactions, representing a complex ecosystem of strategic partnerships, risk assessment, and potential long-term collaboration.

According to the U.S. Small Business Administration, startup fundraising involves identifying and obtaining capital through multiple channels, which can include:

- Personal savings and bootstrapping

- Friends and family investments

- Angel investor contributions

- Venture capital funding

- Institutional investment rounds

- Government grants and loans

Understanding Investment Dynamics

Successful startup fundraising requires founders to articulate a compelling business narrative that demonstrates significant growth potential. Investors are not merely providing financial resources but are essentially betting on the startup’s ability to disrupt markets, solve critical problems, and generate substantial returns. This means founders must present clear value propositions, robust business models, and credible strategies for scaling their ventures.

The fundraising journey is inherently iterative, with each investment round representing a milestone in the startup’s evolution. Early-stage investments typically focus on proving concept viability, while later rounds concentrate on accelerating market penetration and achieving sustainable growth. Founders must strategically navigate these stages, understanding that each funding phase comes with specific expectations, dilution considerations, and potential strategic alignments with investor priorities.

The Importance of Startup Fundraising: Why It Matters

Startup fundraising transcends mere financial transactions, representing a critical catalyst for transformative business growth and innovation. Beyond securing monetary resources, this process enables entrepreneurs to validate their concepts, attract strategic partnerships, and build the foundational infrastructure required to compete in complex market environments.

Fueling Operational Potential

Fundraising serves as the lifeblood for emerging ventures, providing the essential capital necessary to translate theoretical business models into operational realities. Without adequate funding, promising ideas remain confined to conceptual stages, unable to overcome the significant barriers of initial development, market entry, and scalable infrastructure creation.

According to research from the National Bureau of Economic Research, external capital plays a pivotal role in startup survival by enabling critical activities such as:

-

Conducting comprehensive market research

-

Developing minimum viable products

-

Recruiting specialized talent

-

Investing in technological infrastructure

-

Supporting initial marketing and customer acquisition efforts

Strategic Ecosystem Development

Beyond financial resources, startup fundraising represents a nuanced process of building comprehensive business ecosystems. Investors do not merely provide capital but bring invaluable networks, strategic guidance, industry expertise, and credibility that can dramatically accelerate a startup’s trajectory. The right investment partner transforms funding from a transactional event into a collaborative growth opportunity.

The fundraising journey enables startups to progressively demonstrate their value proposition, attracting increasingly sophisticated investors as they achieve meaningful milestones. Each funding round represents more than monetary injection it symbolizes external validation of the startup’s potential, creating a virtuous cycle of credibility, network expansion, and strategic momentum.

Different Types of Funding: How They Work

Startup funding represents a diverse landscape of financial strategies, each offering unique advantages and challenges for entrepreneurs seeking to transform innovative concepts into market-ready solutions. Understanding these funding mechanisms is crucial for founders navigating the complex terrain of business capitalization and growth strategies.

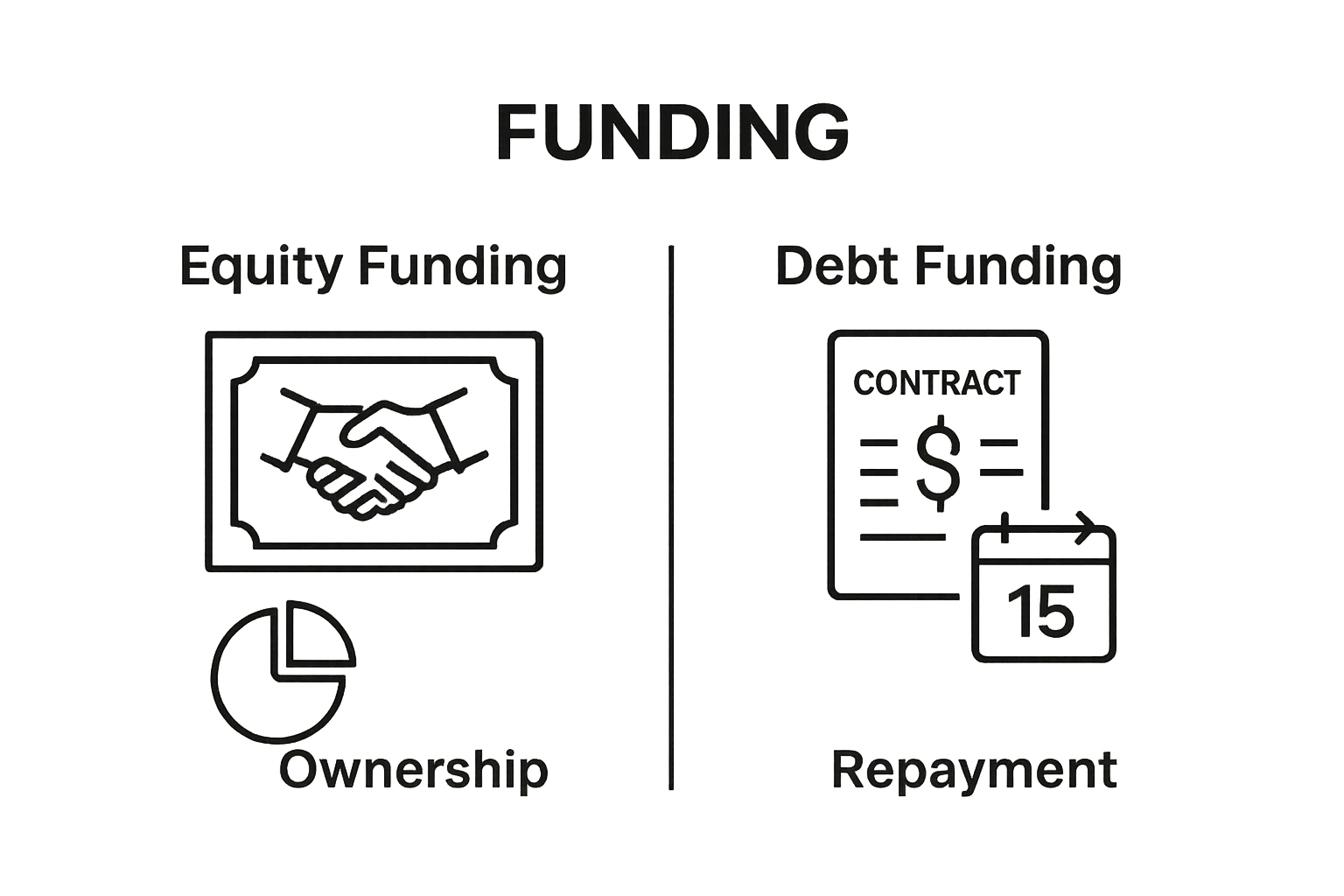

Equity-Based Funding Models

Equity funding involves exchanging ownership stakes in a company for financial investment. Investors receive shares or ownership percentages, effectively becoming partial business owners with potential future returns. This approach allows startups to secure capital without immediate repayment obligations, making it particularly attractive for high-risk, high-potential ventures.

According to Johns Hopkins Technology Ventures, equity funding typically encompasses several key sources:

- Angel investors

- Venture capital firms

- Crowdfunding platforms

- Corporate investment groups

- Institutional investment rounds

Debt and Alternative Financing Approaches

Debt financing provides an alternative pathway for startups seeking capital without diluting ownership.

This model involves borrowing funds with a contractual agreement to repay the principal amount plus interest over a specified timeframe. Debt instruments range from traditional bank loans to more innovative financing mechanisms like convertible notes and revenue-based financing.

This model involves borrowing funds with a contractual agreement to repay the principal amount plus interest over a specified timeframe. Debt instruments range from traditional bank loans to more innovative financing mechanisms like convertible notes and revenue-based financing.

Startups must carefully evaluate the trade-offs between equity and debt financing, considering factors such as ownership preservation, repayment capacity, and long-term financial flexibility. Each funding approach carries distinct implications for business governance, strategic decision-making, and potential future investment opportunities.

The table below summarizes and compares the main types of startup funding discussed, highlighting their key characteristics and trade-offs for founders.

| Funding Type | Source Examples | Ownership Impact | Repayment Obligation | Typical Use Case |

|---|---|---|---|---|

| Equity-Based Funding | Angel investors, venture capital, crowdfunding | Dilutes founder equity | No immediate repayment | High-growth, early-stage startups |

| Debt Financing | Bank loans, convertible notes | No ownership dilution | Principal + interest | Short-term needs or capital equipment |

| Alternative Financing | Grants, revenue-based financing | Usually no dilution | Varies by instrument | Niche or industry-specific opportunities |

Successful founders recognize that fundraising is not just about securing capital but strategically aligning financial resources with their comprehensive business vision.

Key Concepts in Startup Fundraising: Understanding the Terms

Startup fundraising involves a complex ecosystem of financial terminology that founders must comprehend to effectively navigate investment landscapes. Understanding these specialized terms transforms fundraising from an intimidating process into a strategic dialogue between entrepreneurs and potential investors.

Investment Valuation Fundamentals

Valuation represents the financial assessment of a startup’s worth, determining how much equity investors receive in exchange for their capital. Pre-money valuation reflects the company’s value before external investment, while post-money valuation includes the newly injected capital. These calculations are critical in establishing ownership percentages and potential future returns.

According to University of Maryland’s Startup Language Essentials, key valuation concepts include:

- Equity stake percentages

- Dilution mechanisms

- Capitalization tables

- Convertible instruments

- Preferred stock arrangements

Financial Metrics and Performance Indicators

Investors rely on specific metrics to evaluate a startup’s potential and financial health. Burn rate indicates how quickly a company consumes its available capital, while runway represents the estimated time a startup can operate before requiring additional funding. Entrepreneurs must demonstrate not just innovative concepts but also financial discipline and growth potential.

Understanding these technical terms enables founders to communicate more effectively with potential investors, transforming fundraising conversations from transactional interactions into strategic partnerships built on mutual understanding and clear financial expectations.

Here is a table explaining essential startup fundraising terms and their meanings for quick reference.

| Term | Definition |

|---|---|

| Pre-Money Valuation | The startup’s estimated value before any new investment is added. |

| Post-Money Valuation | The company value after adding the capital raised during a funding round. |

| Equity Stake | The ownership percentage an investor receives in exchange for their investment. |

| Dilution | The reduction in existing owners’ percentage share after new equity is issued. |

| Capitalization Table | A spreadsheet showing ownership stakes, investor shares, and breakdowns post-investment. |

| Burn Rate | The rate at which a company spends its available cash each month. |

| Runway | The estimated number of months a company can operate before running out of cash. |

The Role of Investors: Who They Are and What They Seek

Investors represent far more than financial contributors in the startup ecosystem. They are strategic partners who provide critical resources, expertise, and networks essential for transforming innovative concepts into sustainable, scalable businesses. Understanding their motivations and expectations is crucial for entrepreneurs seeking meaningful investment relationships.

Investor Landscape and Categories

The startup investment landscape encompasses diverse investor types, each with unique investment philosophies and engagement models. Early-stage funding typically involves smaller, more personal investment approaches, while later stages attract more institutionalized investment strategies.

According to the U.S. Securities and Exchange Commission, key investor categories include:

- Friends and family investors

- Angel investors

- Venture capital firms

- Corporate investment groups

- Institutional investment funds

Investment Motivations and Expectations

Investors are fundamentally seeking opportunities that promise substantial returns and demonstrate transformative potential. Beyond financial metrics, they evaluate startups based on team capability, market understanding, and innovative problem-solving approaches. Successful founders recognize that investors are not merely writing checks but actively seeking compelling narratives of potential disruption and scalable business models.

The investment relationship extends far beyond capital injection. Sophisticated investors bring industry connections, strategic guidance, operational expertise, and credibility that can significantly accelerate a startup’s growth trajectory. Entrepreneurs who view investors as collaborative partners rather than transactional financiers are more likely to build long-term, mutually beneficial relationships that extend well beyond initial funding rounds.

This table highlights the main categories of startup investors, detailing their characteristics and when founders typically encounter them during the fundraising journey.

| Investor Category | Typical Stage | Characteristics | Value Beyond Capital |

|---|---|---|---|

| Friends and Family | Idea/Seed | Personal networks, informal terms | Emotional support |

| Angel Investors | Seed/Early | Affluent individuals, mentor role | Guidance, early advice |

| Venture Capital Firms | Early/Growth | Institutional funds, larger capital, formal processes | Industry connections, scaling |

| Corporate Investment Group | Growth/Late | Partner companies, strategic alignment | Access to markets/resources |

| Institutional Funds | Expansion/Late | Pension, mutual or private equity funds | Late-stage validation |

Turn Fundraising Complexity Into Growth with Expert Guidance

Struggling with the challenges of startup fundraising? Navigating equity deals, understanding valuation, and attracting strategic investors can be overwhelming for founders aiming to scale. Many startups never reach their potential simply because they lack the support and direction to transform great ideas into operational success. At Noch Consulting, we offer hands-on partnership and tailored support for every fundraising stage, from pre-seed to Series A and beyond. Our team has helped manage over 1000 successful deals across industries like AI, healthcare, fintech, and more, using our experience to help startups secure not just investment, but the strategy and mentoring to grow.

Ready to move your fundraising journey from confusion to clarity? Visit Noch Consulting now to discover how our proven expertise in fundraising, growth strategy, and investor relations can empower your venture. Schedule a consultation today and see how a true execution partner can make your vision a reality.

Frequently Asked Questions

What is startup fundraising?

Startup fundraising is the process of acquiring external capital to turn innovative business ideas into operational realities. It involves securing financial resources through various channels to support product development, market expansion, and business infrastructure.

Why is startup fundraising important?

Startup fundraising is critical because it provides the necessary capital to transition ideas from concepts to actual businesses. It enables entrepreneurs to validate their ideas, invest in their operations, and attract strategic partnerships that can accelerate growth.

What are the different types of funding available for startups?

Different types of funding for startups include equity-based funding (like angel investors and venture capital), debt financing (such as loans and convertible notes), and alternative financing options. Each type has its advantages and challenges related to ownership and repayment.

How do investors evaluate startups during fundraising?

Investors evaluate startups based on various factors, including the startup’s financial health, market potential, team capability, and innovative solutions. They look for compelling narratives that demonstrate growth potential and indicate a good return on investment.