Having a plan to raise the capital needed for your company is the first step in raising money. Our leadership has worked as fund managers and has invested in dozens of competitive companies across various verticals. Additionally, our team has evaluated hundreds of pitches and has a solid understanding of how to get a project funded. Our approach aligns with what a VC investor would look for if they were going to invest in your project.

Although the depth of the pitch might vary depending on your vertical, there are several key points that every capital raising strategy should include: the timeline, capital breakdown, leadership of the fundraising process, and most importantly, identifying the right funds or investors to contact.

At Noch Consulting, we understand that each startup has unique needs and goals. We tailor our capital raising strategies to fit your specific circumstances, which involves a comprehensive approach through several key phases:

We start by assessing your startup’s current financial status and future funding requirements. This analysis helps in setting realistic targets and timelines for your capital raising rounds.

Our team works closely with you to prepare compelling pitch decks and detailed financial projections that effectively communicate the value proposition of your startup to potential investors.

Leveraging our extensive network and market research, we identify potential investors who align with your startup’s vision and sector. This targeted approach ensures that we focus on the most promising opportunities for successful funding.

With all materials and plans in place, we guide you through the execution of your capital raising strategy, from initial investor outreach to follow-up meetings.

A well-structured capital raising strategy provides several benefits including increased efficiency, which streamlines the fundraising process, saving time and resources. It enhances investor appeal by clearly articulating your value and growth potential, making your startup a more attractive investment opportunity. Additionally, it optimizes funding outcomes by aligning investor expectations with your business goals, enhancing the likelihood of securing the necessary capital.

Benefit from our unique blend of founders, lawyers, and investors, ensuring comprehensive, industry-specific guidance

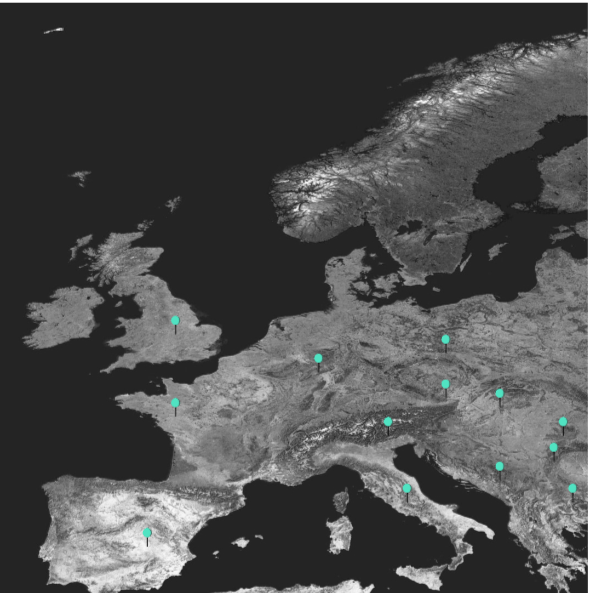

Leverage our established network and proven success across the U.S. and EU to gain access to key markets and stakeholders.

Avoid common early-stage pitfalls with our proactive advice, saving you valuable time and resources.

Receive personalized consulting tailored to your specific objectives, ensuring targeted and effective outcomes.

Are you ready to raise capital? Book a free call and pitch us your idea to see if we believe you’re ready. Our expert team is eager to guide you through every step of the fundraising process.

Book your consultation now and start your journey to securing the capital you need.

Adding {{itemName}} to cart

Added {{itemName}} to cart